Renting the Future

At MSBC we spend a lot of time helping founders understand how to apply AI in the real world. One lesson shows up repeatedly across industries and business models. It mirrors a broader economic shift that has been underway for more than a decade.

We now operate in an economy built largely on renting. A small number of companies own or control the physical infrastructure and most businesses pay for access.

Cloud platforms replaced owned servers. Companies no longer maintain racks of hardware in back rooms. Uber challenged the idea that every trip requires a private car. Airbnb showed that accommodation could be treated as a flexible marketplace rather than an asset you need to hold. Even critical business systems are delivered as subscriptions rather than software you install and manage.

Renting works because infrastructure is expensive, specialist skills are scarce, and setup takes time. It removes friction and lets companies scale without large up-front investment.

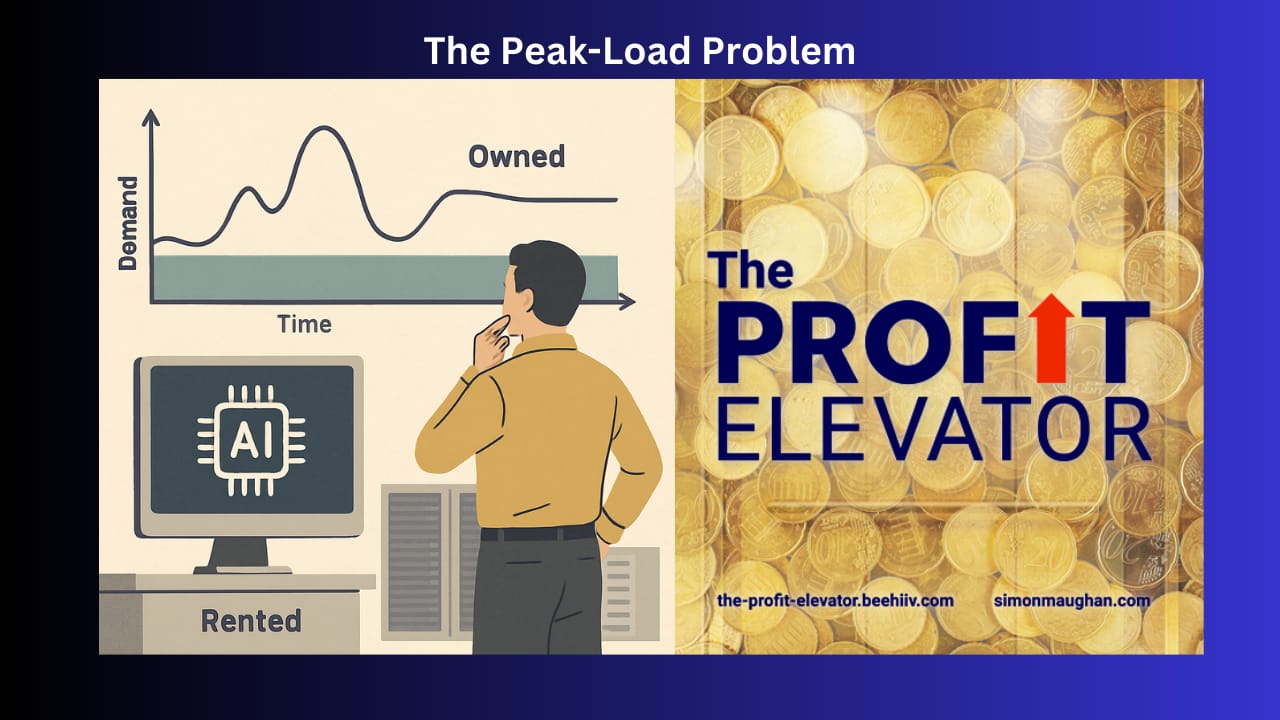

The model has limits. When demand spikes, rental systems can fail at the point of maximum need. A service designed around shared resources risks being oversubscribed at exactly the time it must perform. Cloud services can throttle. Ride-hailing prices surge. Accommodation disappears for major events.

These situations highlight a structural issue. If your business is built on someone else’s capacity, you become vulnerable at peak load. When designing a business model or an internal workflow, you need to understand not just average demand but its extremes.

Renting Abundance

There is a competing view that argues the peak-load problem is fading. Advocates of an abundance model point to the history of cloud computing. Over the past twenty years, hyperscale providers have added capacity faster than demand has grown. The price of compute and storage has fallen steadily.

Bandwidth has expanded to the point where most companies treat it as effectively unlimited. In that context, the fear of running out of capacity became a temporary stage rather than a long-term constraint.

A similar pattern may unfold in AI. Each new generation of hardware increases inference throughput. Models are being quantised, distilled and compressed to deliver more intelligence per watt. Serving stacks are becoming far more efficient.

If this trajectory continues, the marginal cost of inference could fall faster than the growth in aggregate demand. In that world, concerns about peak load decline in relevance. Renting intelligence would remain a viable, flexible, low-risk approach even at scale.

It is also worth noting that software does not share the same physical constraints as transport or real estate. You cannot build enough roads to eliminate rush-hour congestion. You won’t construct unlimited hotel rooms in a seasonal market. But you can add more compute in data centres around the world. If supply grows elastically, the bottlenecks seen in other industries may not apply.

Adapting Small Businesses

The stock market’s reaction to AI is a reminder that value has so far accrued mainly to hyperscalers and their suppliers. Most of the broader market has been cautious because many AI projects rely on a cost structure that does not improve with scale.

When everything runs through a rented model, your economics depend directly on usage. You pay for every request, yet most customers expect a fixed monthly price. As volume rises, margins can compress. Some companies end up growing without becoming more profitable.

The same challenge applies whether you are launching a product or a new business process. The largest companies can overcome the peak-load problem because they have the resources to invest in on-premise servers and private clouds. These costs have not fallen to the point where owning is a viable alternative to renting for small businesses.

This leaves the challenge of how to scale using rented intelligence. You have the same peak demand failure mode seen in other as-a-service categories. If your business relies on offering fast, reliable results at any hour of the day, that uncertainty is dangerous. This is the same whether you use AI to power a product or an internal process.

This shift mirrors the broader pattern seen in every industry moving from rental dependence to infrastructure ownership. Businesses rent when they are small. As they mature, they move to own because reliability, margin and control matter more than ease of setup.

Before considering how AI will impact your business, or introducing a new product, or refining a business process, ask yourself these three questions:

Questions to Ask and Answer

Does my service have demand peaks?

Are my costs flexible and my revenues fixed?

How can I mitigate peak loads to preserve margins?

If you do not have the capacity to alter the operational leverage in your business, then you will need to make changes to the business model.