Startup Mathematics

Startup maths is very simple. 93% of small business owners start out with less than 18 months of financial runway. Yet according to Earthweb it takes an average of four years to make money and seven to create a steady money-making machine.

There are exceptions and that is the point. They are exceptions. Four years is an average and every story of a founder who made it quicker means there is another who took longer or never made it.

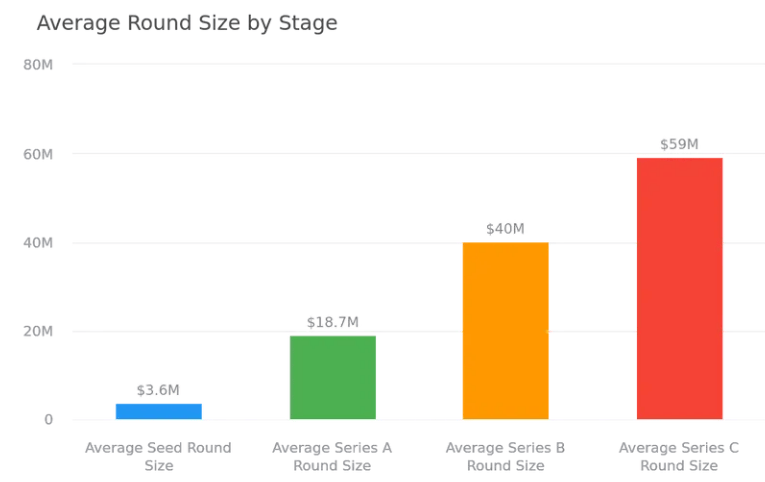

The good news is that if you go down the funding route and make it to Series C, your chance of failure falls to just 1%. Series C is traditionally the final funding round before going public and according to Mosaic there were only 55 such deals in Q1 2023.

Source: Crunchbase via Visible.vc

With roughly 18 months between rounds you must survive for up to six years to make it to a liquidity event. If you start with less than 18 months of funding the pressure to raise money is constant and you will be distracted from creating a successful business.

A Failure of Imagination

A major cause of running out of runway, according to Failory, is it takes between two and three times longer than expected to validate an idea. It is extremely rare that you create the ideal product at the first go and you must adapt to feedback and iterate.

It is important to get a product into the market for testing quickly and to reserve adequate time to adapt. A big failing I’ve noted with startups is the engineering team moves onto new projects once a product is launched and there is no time to reengineer the product so that it sells.

In the worst cases there is open hostility to rebuilding and heads of engineering wash their hands of a product saying it’s a sales problem now. Big mistake.

Another reason for underestimating the time to breakeven is the valuation of intellectual property. Small Biz Trends reports that founders overestimate the value of intellectual property by 255%.

These are failures of imagination. Founders cannot imagine that their product will not sell or the extent to which it will need improvements to find product market fit. They fixate on a number and won’t change their mind.

Signs that you are doing this include ignoring feedback from early adopters, over optimistic budgeting and resisting giving away information as part of the sales process. Founders convince themselves people will steal their idea, when the reality is no one knows what it is because you don’t share.

A last minute change of heart

In the first technology startup I worked with over a decade ago we built analytical software for stock market investors. The founder convinced himself that hedge funds would generate millions of dollars using our signals before the platform was tested with a single one. As a result, he budgeted to sell ten licences for a million dollars each.

Creating something worth a million dollars to a single user requires substantial investment. Soon the business was loaded with costs and the internal demands to put more into the product kept rising. There were no clients on the horizon.

Eventually the founder accepted a strategic pivot. The product was simplified and the price point lowered. At first it dropped to $100,000 and then to $10,000 per user. By making a simpler product with broader appeal, we generated demand from multiple users and were able to strike enterprise deals for between a quarter and half a million dollars each.

Cash is king

Small Biz Trends also reports that over half of businesses launch with less than $25,000 of funding. You aren’t paying wages out of that and have to be extremely careful about spending commitments. You need to get to market quickly, test your idea, adapt it and get cash coming through the door.

At this stage profitability is secondary. Cash is king and you must get per unit costs down to generate cash on every sale, otherwise you exhaust your resources. Have customer make deposits, pay up front or sponsor trials of the product in return for long-term discounts. Do not extend credit and however good a customer may seem, if they won’t support you, they are no good at all.

5 financial checks to do today

If you are already shipping product use these 5 calculations to check your financial runway.

Step One

Take a look at your financial projections and calculate these ratios:

The percentage of leads to conversions

The percentage of full price conversions

The percentage of repeat customers

The percentage of bad debts

The number of debtor days (trade receivables / credit sales x 365).

Step Two

Now take 10 percentage points from ratios 1 through 3. For example, if you assume 100% of customers renew a subscription or buy your product again, reduce the assumption to 90%.

Next increase your assumption for bad debts by 5 percentage points, for example from 5% to 10% of sales. Finally double your debtor days if your assumption is less than 30 and add 50% if it is greater.

Step Three

Now rerun your budget using these five new ratios. Will your business generate cash and do you have the resources to last to the time that it does?

If not, you are on the wrong side of the startup maths.

P.S. If you’d like help calculating any of these ratios or with financial forecasting in general, hit reply to this edition and we’ll have a chat.

I'm Simon Maughan and I write The Profit Elevator as a guide for smaller businesses to accelerate growth. Please share this newsletter with a friend or two who is trying to scale their business.