Good product does not sell itself

Why doesn’t good product sell itself? One reason is that no one has heard of it and a marketing campaign is needed. Another is that potential clients are already buying from the competition.

The worst way to spend your money

Thinking the world is waiting for your product is a mistake. Only 5% of SaaS customers are ready to buy, according to the B2B Institute. They are the needle in the haystack. Trying to find them by presenting to as many people as possible is not the best way to spend your marketing budget.

To find out if your sales and marketing is efficient use the magic number.

The big mistake people make is sizing the market and assuming everyone is a buyer. A focus on fundraising means you talk about TAM – total addressable market. This is the largest revenue pool you can justify to impress would-be investors. But don’t believe your own hype and fall into the trap of managing your business as if this market is accessible.

Every business has competition

I worked with two small companies whose founders at first said they didn’t have competition. They also thought they had huge addressable markets. Unless you’re the first to manage nuclear fusion, every large market has competitors. If you don’t see them, you haven’t looked hard enough.

In fact, even fusion has competition. Energy is generated in other ways and transmission systems, storage and downstream supply are set up to work with competing power sources. The energy market also has significant vested interests. Dislodging those may be the greatest challenge for nuclear fusion.

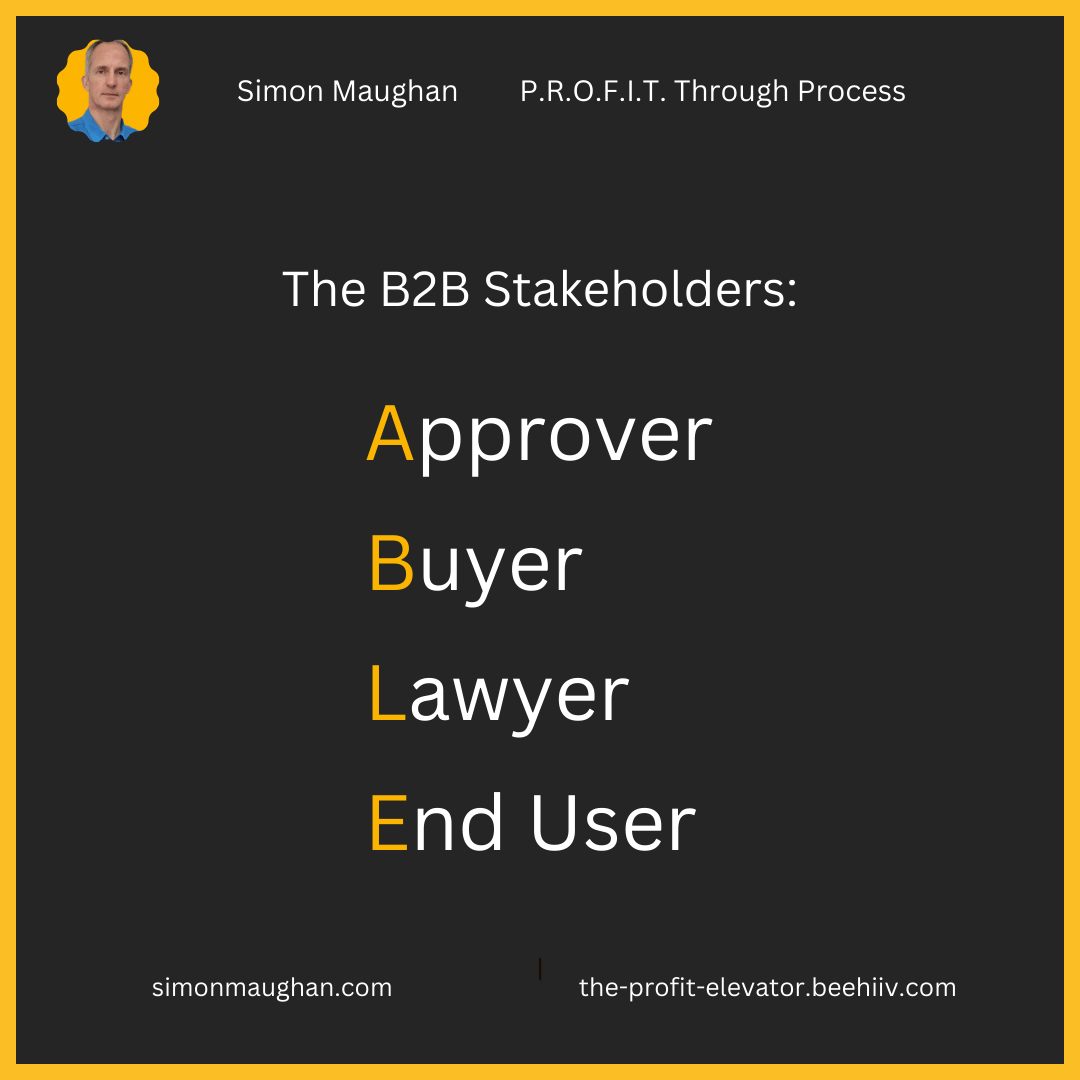

Understanding the Stakeholders

The 95% of the market that is not ready to buy will provide a healthy pipeline. Creating this uncovers those who are ready and a few more who didn’t know they were. The remaining willing and able buyers are your pipeline. Find them quickly and disqualify the rest.

To do this answer one, simple question. Why do people buy from you? Companies debate why deals were lost, but are less likely to analyse wins. This is a mistake.

In most B2B deals there are stakeholders. Each has a different motivation and a veto over the deal. How you persuade each one is critical information when building a scalable sales process.

The Authority is the name on the contract. In smaller companies they may be the Buyer, but corporations have a separate procurement team. The Lawyer approves the contract for signature, while the End User is the person sales people typically see as the client.

At my first tech startup, OTAS Technologies, the end user was a stock market trader or fund manager. They rarely controlled the budget or had the authority to make deals. The first step to a sale was making them an internal champion.

This is the person who helps you navigate a target organisation. They may not know the buying process and you need to explain the different stakeholders to them.

At big banks and investment managers, a procurement team is rewarded for getting a discount. I needed to find out if clients had such a team. If they did, then a higher proposal price left me room to give a discount. The initial ticket price did not deter users who weren’t part of purchasing.

The fastest deals at OTAS were with a standard contract, but only around 20% of clients signed this. The largest clients sent me their purchase terms. The details were standard and the reputational risk to these companies is too great to not pay. I learned that signing and starting quickly was better for cashflow than negotiating.

I did negotiate with firms that had a legal process and internal or external counsel. Both demanded changes to contracts to justify their role. I kept a second version of our standard terms with some juicy titbits the lawyers could strike out, without putting redline issues at risk.

Once these hurdles were overcome signing was simpler. If the Buyer did want a call, it was usually to demonstrate authority. I often offered more users for the same price at this stage to secure the deal. Embedding OTAS into an organisation boosted renewals and referrals.

What to do next

As an exercise, choose a client contract that you won. Write down who the stakeholders were and their motivations. Consider how you won each one over. Write it in a way that can be repeated and taught to others. This is the core of your sales process.

You must understand the buying system at target clients before starting the sales process. This is what market research means. It is often overlooked once market size and competition have been assessed, but this element will make or break your sale.

Members of your sales team are super sleuths who uncover the intelligence you need to close a contract. The skills required are much more than understanding and pitching product.

I'm Simon Maughan and I write The Profit Elevator as a guide for B2B businesses to accelerate growth. Research is part of the Go-to-Market Guidebook in my P.R.O.F.I.T. Through Process Programme.

If you found this letter valuable, please share it with a colleague and a friend.