In the early days, OTAS Technologies risked running out of cash. Balancing spending on growth with paying the bills took me three hours a day. I used Silicon Valley metrics to control risk.

40x Revenue

OpenAI plans to raise $6.5 billion at a $150 billion valuation. Its annualised revenues are $3.4 billion. How is a such a valuation justified?

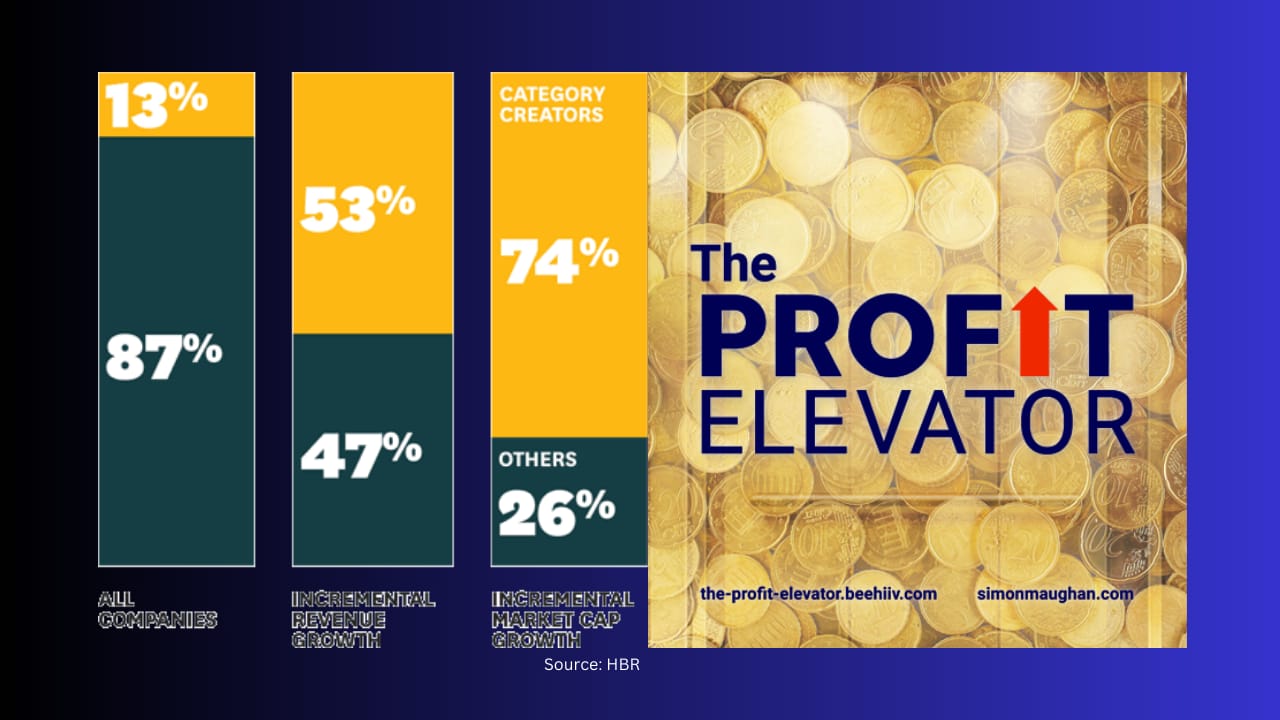

The Harvard Business Review says that category creators are 13% of companies, gain around half of revenue growth, and capture three-quarters of the value created. Anthropic valued at $40bn on revenues of $1bn, is rated in a similar way to OpenAI.

Silicon Valley’s 10 Metrics

Venture Capital investors have 10 core financial metrics to assess a company. They form part of any due diligence. It’s important to know them even with no plans to raise outside funds. They are the way you control your financial risk.

Growth Metrics

Growth is a priority for both scaling businesses and their investors. The simplest measure is the change in annualised revenue run rate (ARR). OpenAI’s ARR of $3.4 billion is based on sales in the first six months of 2024. That’s up over 200% from a year ago.

Thereafter, it’s important to understand how much of the new revenue is sticky. Gross dollar retention takes into account cancelled and completed contracts, while net also includes sales to existing clients.

Competitive Advantage

Investors care whether they are asked to contribute more money and what it will be used for. Gross margin measures a firm’s ability to fund its go-to-market and product development. Once sales start, investors prefer to contribute capital to boost growth.

Free cash flow margin is the rate at which sales are turned into cash and is another measure of the need for funding.

Sales Efficiency

A lot of marketers focus on customer acquisition cost. Silicon Valley investors see this as an input into other ratios, because on its own it reveals little.

The gross-margin adjusted, customer acquisition cost payback period, is the preferred measure of client acquisition and retention costs.

A simple alternative is the Magic Number. This measures how long it takes to recoup sales and marketing costs. Fast-growing, loss making businesses are encouraged to spend more on go-to-market, provided at least three-quarters of the costs are recovered near term.

Capital Efficiency

The final set of ratios measures how well businesses use the money entrusted to them. The Rule of 40 might be dismissed by accountants, but is used to show the balance between growth and profitability. Revenue growth and free cash flow margin should add to over 40.

This means faster growing businesses have less need to generate cash, but as growth slows that must change. While they are cash negative, the revenue burn multiple helps predict when more funding will be required.

The final ratio is ARR per full time employee. This is a measure of productivity and determines if a business has over-hired.

Benchmark Metrics

Andreessen Horowitz provides benchmark metrics for the median SaaS company.

Metric | ARR <$20 million | ARR $20-50 million | ARR > $50 million |

|---|---|---|---|

YoY ARR Growth | 185% | 112% | 91% |

Gross Dollar Retention | 90% | 90% | 90% |

Net Dollar Retention | 149% | 128% | 121% |

Gross Margin | 68% | 63% | 71% |

FCF Margin | -200% | -107% | -32% |

Gross margin-adjusted CAC | 18 months | 12 months | 11 months |

Magic Number | > 0.75 | > 0.75 | > 0.75 |

Rule of 40 | 55% | 51% | 37% |

Revenue Burn Multiple | -2.4x | -1.8x | -0.6x |

ARR per FTE | $84,000 | $147,000 | $173,000 |

As these are averages, just matching them is unlikely to be enough to secure funding from a top Silicon Valley venture capitalist.

Metrics for small businesses

Small business owners use these metrics because they are more predictive than standard accounts. Projections about when cash will run out are particularly useful. I calculated these almost daily when cash was tightest at OTAS Technologies.

How to calculate and interpret these ratios is part of the Cash Flow Calculator. This is the Finance element of my Six Steps to Scale any Business. The link is to the course home page where it is available for a special rate.

Questions to Ask and Answer

How much runway does my business have before it needs more cash?

Do I have the right balance between growth and cash generation?

What is the contribution to growth from existing clients?

I’m Simon Maughan and I write The Profit Elevator as a guide for B2B firms seeking faster growth.

If you found this letter valuable, please share it with a friend and a colleague.