Gobbledygook

Last month, I advised a client about automating the accounting of its securities settlement processes, to align with industry best practice and match its custodial agent. If that is gobbledygook to you, then you may need the primer I immediately thought about writing.

That evening I went to boxing class. My instructor was excited to show me his crypto portfolio, which had risen fourfold in a matter of weeks.

“You don’t get that from the bank, Simon” he mused.

I asked him what Fantom did, as it was his largest holding.

“I just buy what people tell me to” he replied, noting that his tip was good through December.

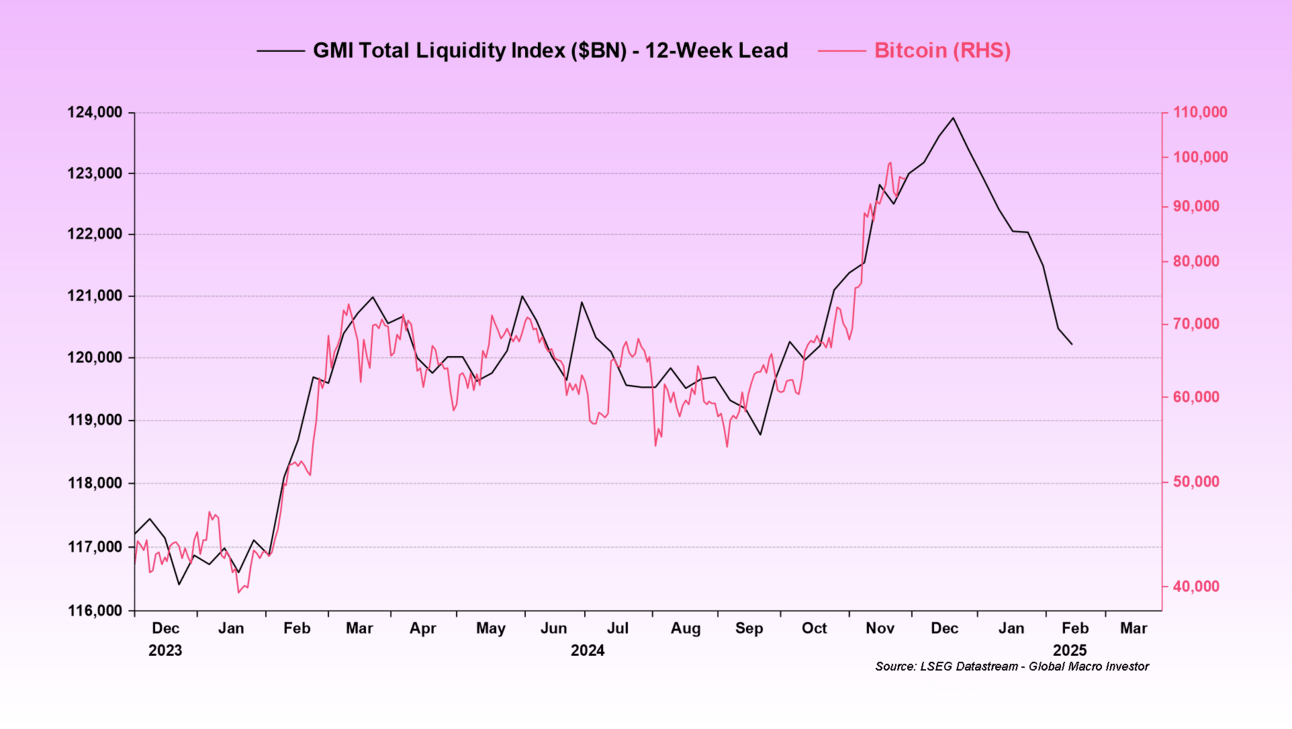

I cautioned that it’s important only to take advice from people who will tell you both good and bad news. Only listen to buyers who will also tell you to sell. Beyond that, I am not a financial advisor and, in any case, Raoul’s chart seems to agree.

Source: Global Macro Investor from Raoul Pal

The point of this is that there is a small audience for expert opinions in niche markets, and a big market for trending opinions on social media. Laying out expert views in white papers may feel rewarding, but there is a reason academics are taking up podcasting. No one reads their research, but many listen to their opinions. My current favourite is Past Present Future.

As I stew over this, I think about hiring plans for 2025. I have budget for an email marketer, but on reflection this money is better spent elsewhere. The initial candidates were perfect for a brand that wants to blast the market and is happy with minimal response rates. That is not the right strategy for the brand I am representing.

It’s easy to get caught up in advice about what’s working and what isn’t. The more it works, the more reminders you see. The mounting excitement is what attracts suckers in at the end of cycles and leaves the unsuspecting nursing losses.

This applies as much to marketing as it does to investing.

Pivoting to AI

My client is pivoting into providing AI services. It’s a wide field and the first challenge is to find a niche. The CEO of a company I worked with would always answer “both” when given an either, or choice. He seemed to think this was funny, clever and entrepreneurial. After all, Amazon has multiple billion dollar revenue streams.

Not many businesses are Amazon, however. The ambitious CEO spread his investments and split his time between numerous projects. His business trips invariably resulted in another great idea, more cost, more hiring and less focus. I stopped working with him when I realised this was not going to change even with money running out.

There appears a natural split in the world of AI. On one side are individuals powered by large language models. Many tasks are performed far faster than before, but the jury remains out about the return on investment from these tools. The business case often depends on creating agentic systems, whereby LLMs works with other AI, and this requires additional levels of expertise, data and cost.

At the same time there is considerable progress with other AI systems, such as robotics, computer vision and genetic algorithms for use cases including manufacturing, simulation, prediction and drug discovery. Military applications loom large. It’s important to note there is more to AI that generative AI.

The Power of Partnerships

Selecting a niche is hardest when you have the ability to go in many directions. It is important to invest where the risk adjusted return is highest. For all the heat and light of the LLM market, big business applications seem to offer the best returns.

This rules out pay and spray marketing for my client and suggests using social media only to raise awareness. Even this is tricky, because the noise is around individual achievements such as no code iOS apps, and unlikely to attract the ideal client profile.

Partnerships offer an attractive alternative. These leverage existing brands and client relationships to build a business. The biggest AI brands endorse proven partners with demonstrable skills and my client has worked hard behind the scenes to qualify. We are ready to make considered approaches, which emphasise the firm’s experience in solving business problems through rationalisation and automation of processes.

This a natural direction for my work. I believe in the power of process to scale businesses and for the past 18 months have developed guides to help small businesses accelerate growth. Yet AI offers the promise of a step change in automating processes and it’s big business that is expected to lead the way.

Questions to Ask and Answer

Do you have proven processes that should be automated?

Do you know where the knowledge is that makes these processes work?

Do you have a partner with expertise who will tell you no when it’s the right answer?

When you are ready there are two ways I can help:

1. The Profit Through Process Planner: My flagship course on how to design and invigorate a business that scales. I share 30 years of experience of researching, investing in and running companies, intermingled with the science and stories of business.

2. Resolving Team Conflicts: A free email course tackling an issue that no one ever teaches you as a manager. This is an excellent introduction to one of the foundational understandings of The Profit Through Process Planner.