The Forecaster’s Curse

There is a reason why predictions about capital markets tend to be wrong. The authors of forecasts generally extrapolate trends and cover themselves by saying other things being equal. Other things are never equal.

2024 is a year of elections. Incumbent politicians will do their utmost to have an economy performing as well as possible. Consequently, the risks to forecasts for private equity (PE) and venture capital (VC) are to the upside.

Historically, public stock markets perform best in the third year of the four-year US presidential cycle. But PE and VC do not need markets rallying in order to do deals, and stable markets at high values are potentially more attractive and likely to yield investment exits.

There is a parallel between capital market forecasting and small business budgeting. The most common way to forecast next year is to apply a percentage growth to the current year. In business, that growth rate has more to do with aspirations than the genuine prospect of sales.

The forecaster’s curse is that it’s more likely you’ll spend what you budget for costs than you’ll earn the revenue to cover expenses.

The market leading provider of data for PE and VC markets is Pitchbook. This does not make them a reliable forecaster, but their charts are a good place to start analysing European private capital markets.

Venture Capital is more volatile than Private Equity

Venture capitalists fund startups and smaller deals than private equity. Over longer periods, VC funds outperform because the potential rewards of small businesses are greatest. Over shorter periods, especially a single year, VC returns are more volatile and 2023 was such a year.

The worst year in five in prospect

While PE fundraising held up relatively well this year, VC is likely to have had it’s worst year in five. And by the end of November, the value of exits of VC-backed investments was 10% of the 2022 level.

A Year of Uncertainty

This year was a highly uncertain one for investors, with many expecting inflation and recession at the beginning of the year and being progressively and positively surprised as the months unfolded. It takes time to raise funds and arrange investments and exits, and therefore the caution ruling at the beginning of the year likely dictated trends throughout.

In uncertain times investors look to track records and size for stability. This favours PE over VC and established investors over newcomers. The top three PE investors, CVC Capital, Permira and KKR, raised a record share of the total market in 2023.

The most concentrated market in over a decade

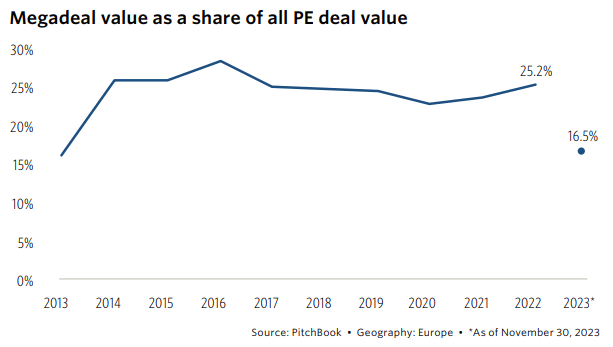

Mega fund raises do not mean megadeals, however. The reason is higher interest rates making debt less attractive. PE deals rely on large amounts of leverage and financial engineering is the primary way external investors create value (and risk). With large debt issues off the table, there was more activity in smaller deals this year.

Megadeals at a 10-year low

European private capital markets are relatively small

Pitchbook reports that European PE assets under management doubled from 2014 to date to over €1 trillion. McKinsey estimates the European market to be one quarter the size of the US, although the gap is closing as deal values are only three times higher in the US. The European market is nonetheless small, reflecting fragmented financial markets, long-term preference for bank funding and conservative attitudes towards financial risk.

Growing from a small base is easier than from a large one and we might expect European markets to surprise to the upside in 2024, especially if interest rates fall and financial conditions loosen.

The caveat is political risk in the UK, where the election may bring a new government intent on overhauling the tax-advantages of private investing. The value of private deals in the UK was more than the French and German markets combined in each of the past three years. Yet given the election is likely to be later in the year and that there were few exits in recent times, a rush to beat any changes to regulations is most likely.

Where capital market and cashflow forecasts diverge

Trend extrapolation is the reason predictions for capital markets are no more accurate than the average small business cashflow forecast.

The outlook for European PE and VC markets is cautiously optimistic, with lower inflation and interest rates and the benefit of higher public market valuations all expected to boost deal volume and value.

With 2024 a year of elections, the risks to these forecasts are to the upside. If only the same could be said about small business sales forecasts.

I'm Simon Maughan and I write The Profit Elevator as a guide for smaller businesses to accelerate growth. Please share this newsletter with a friend or two who is trying to scale their business.